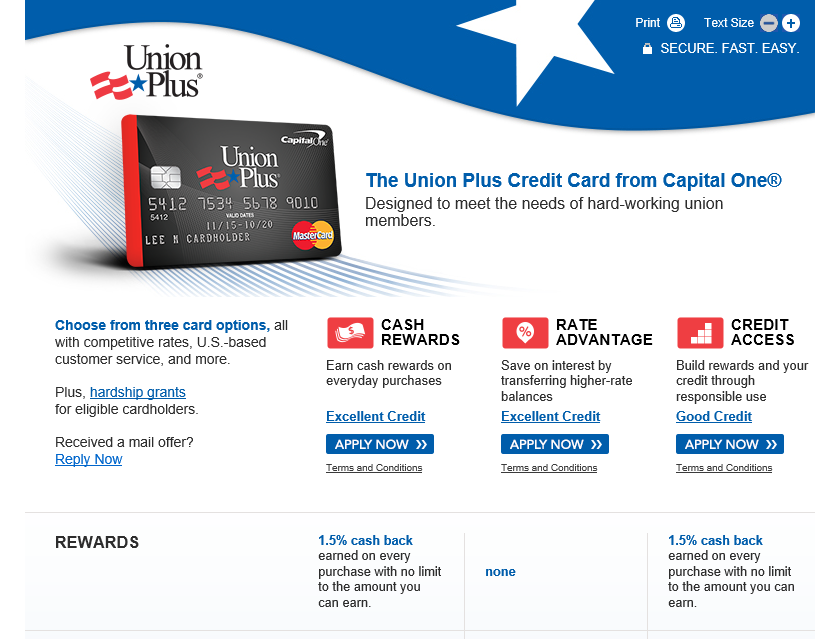

How to Apply for the Union Plus Credit Card

You do not have to break a sweat applying for Union Plus Credit Card. It is a hassle free and straightforward process where you have to follow few simple steps and fill your relevant details in the box provided. You need to fulfill all the eligibility criterions and rules of the company in order to be eligible for this card. The webpage clearly mentions that offer is valid only for current union members in good standing of a participating union, retired union members, family members of a current union member in good standing of a participating union, and members of Working America, who reside in the 50 United States, Washington, D.C., or a U.S. Military location.

You do not have to break a sweat applying for Union Plus Credit Card. It is a hassle free and straightforward process where you have to follow few simple steps and fill your relevant details in the box provided. You need to fulfill all the eligibility criterions and rules of the company in order to be eligible for this card. The webpage clearly mentions that offer is valid only for current union members in good standing of a participating union, retired union members, family members of a current union member in good standing of a participating union, and members of Working America, who reside in the 50 United States, Washington, D.C., or a U.S. Military location. Step 1 - Visit the Company's Website

The first step in the entire application process is visiting the company's website. To apply for Union Plus Credit Card you have to visit the link. The browser will take you to their homepage and you can easily locate the 'Apply Now' button once you are there. You need to click on the button to go to the next page where you are required to fill in the application form.

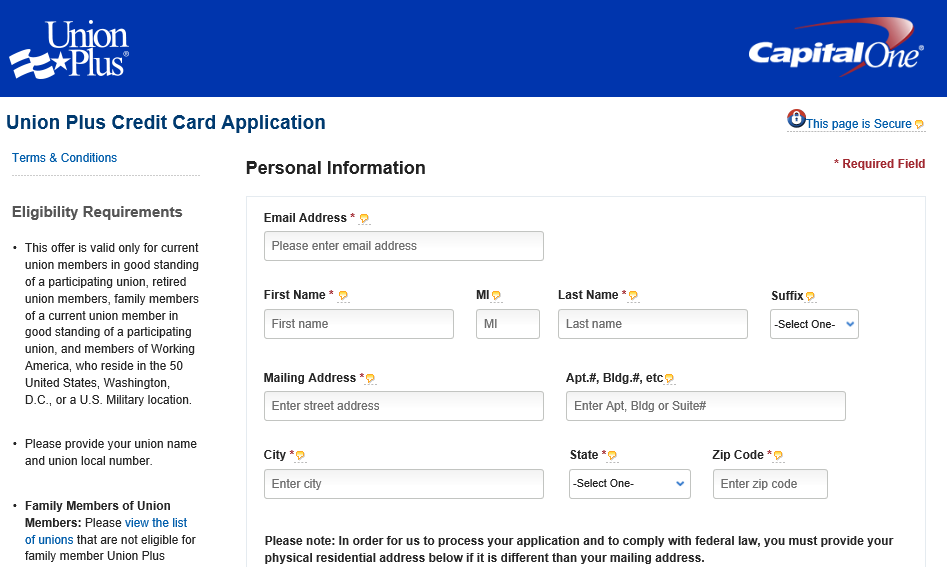

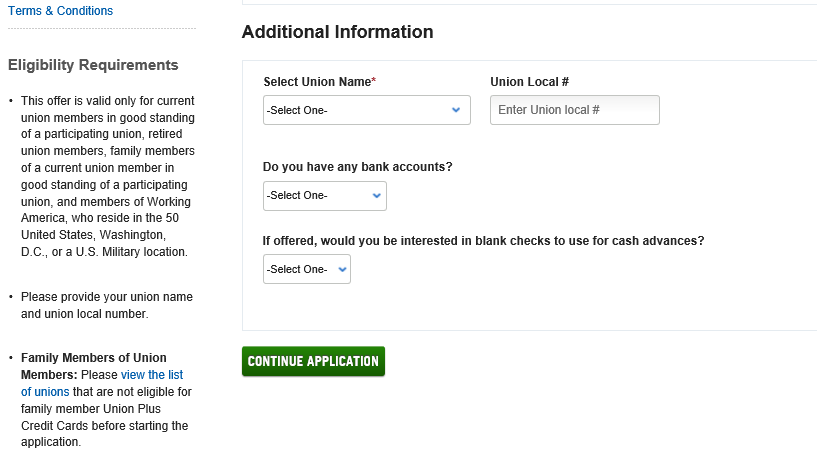

Step 2 - Fill in the Application Form

You will be guided to a personal information form where you have to fill in your first name, last name, address, telephone number, employment status, residence type, etc. It is advised that you remain in possession of all the documents and relevant details to fill in the application form quickly, conveniently and without mistakes. You will agree that it saves a lot of time and inconvenience if you get it right the first time.

The details you have to provide in the application form are as following:

Please be aware that the field marked with asterisk (*) is mandatory and you must provide the relevant information to proceed further.

- Fist Name and Last Name along with Suffix

- Mailing Address (street address including City and State)

- Primary Phone number and Work Phone number

- Email Address

- Annual Net Income

- Security word

- Total Annual Income

- Date of birth

- Union Name, etc.

Please be aware that the field marked with asterisk (*) is mandatory and you must provide the relevant information to proceed further.

Please fill in all the details and then click on the 'Continue Application' tab at the bottom to continue to the next stage.

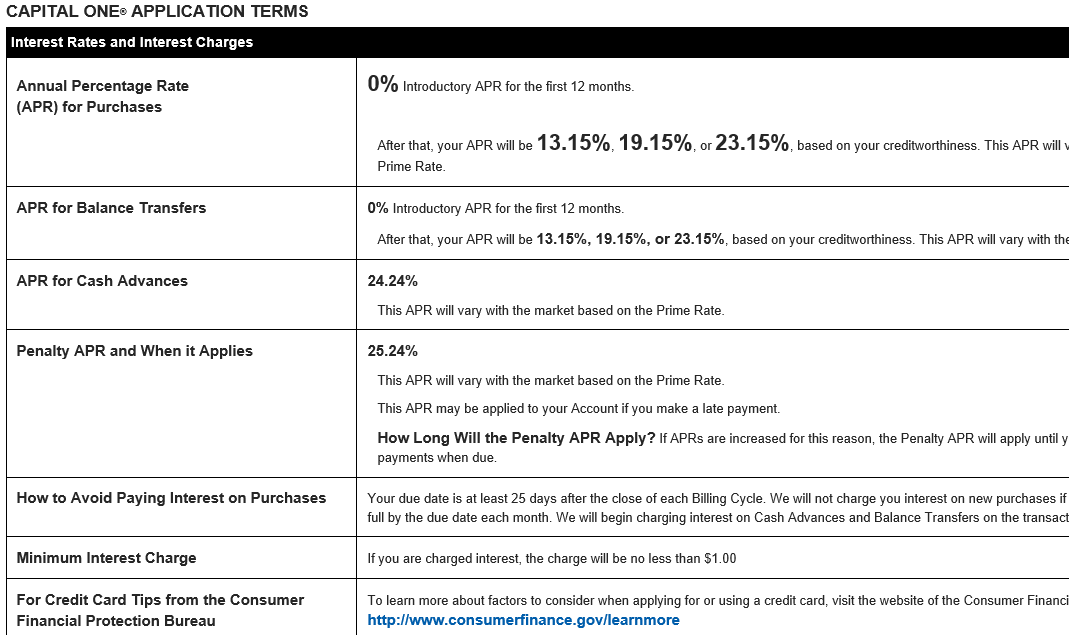

Step 3 - Agreeing to Terms and Conditions

For your utmost convenience, the terms and conditions clause is given just below the 'Apply Now' button. Refer to the picture dealing with your application. It contains important details about interest rates and interest charges, annual fee, transaction fee, penalty fee, the costs, annual percentage rates for purchases (APRs), APR for balance transfer, cash rewards, hardship grants, APR for cash advances, interest payable, annual membership charges and sundry other items which you need to be aware of to stay clear of any possible future penalties and fines. Being clear about the various terms and conditions also puts you in a position to derive the maximum benefit from your Union plus Credit Card.

Step 4 - It is now time to submit your application form

Now the time has come to submit your application form. This part calls for diligent reviewing to ensure everything is in order. It is often seen that we make or ignore silly mistakes which leads to significant wastage of time and causes a lot of frustration. You can also take the help of your colleague or an expert to get a better understanding of the points mentioned in 'Terms and Conditions' section.

Articles Related to Union Plus Credit Card

How to Apply for the Amex EveryDay Preferred Credit Card

How to Apply for the Spirit Airlines World Mastercard

How to Apply for the JCPenney Credit Card