How to Apply for the Charter Oak Visa Platinum Credit Card

You can apply for Charter Oak Credit in three ways. You can either fill in the application form online or you can call the Charter Oak Customer Service or you can personally visit your nearest Charter Oak Federal Credit Union branch.

You can apply for Charter Oak Credit in three ways. You can either fill in the application form online or you can call the Charter Oak Customer Service or you can personally visit your nearest Charter Oak Federal Credit Union branch.To be eligible for Charter Oak Visa Platinum Credit Card, an applicant must satisfy the following requirements.

An applicant must be of 8 years of age or above.

An applicant should be either living or working or studying or volunteering or worshipping at London County or Windham County.

An applicant should have a valid Social Security number.

An applicant should possess a valid identification proof.

An applicant should have an excellent credit score to be eligible for Visa Platinum Card.

Step 1 - Visit the Website

If you choose to fill in the application form online, you can visit the official Charter Oak Credit Union website. The following page will appear.

Click on the Apply Now button below the Visa Card Center.

You will be redirected to another window shown below. Click OK.

Step 2 - Fill in the Application Form

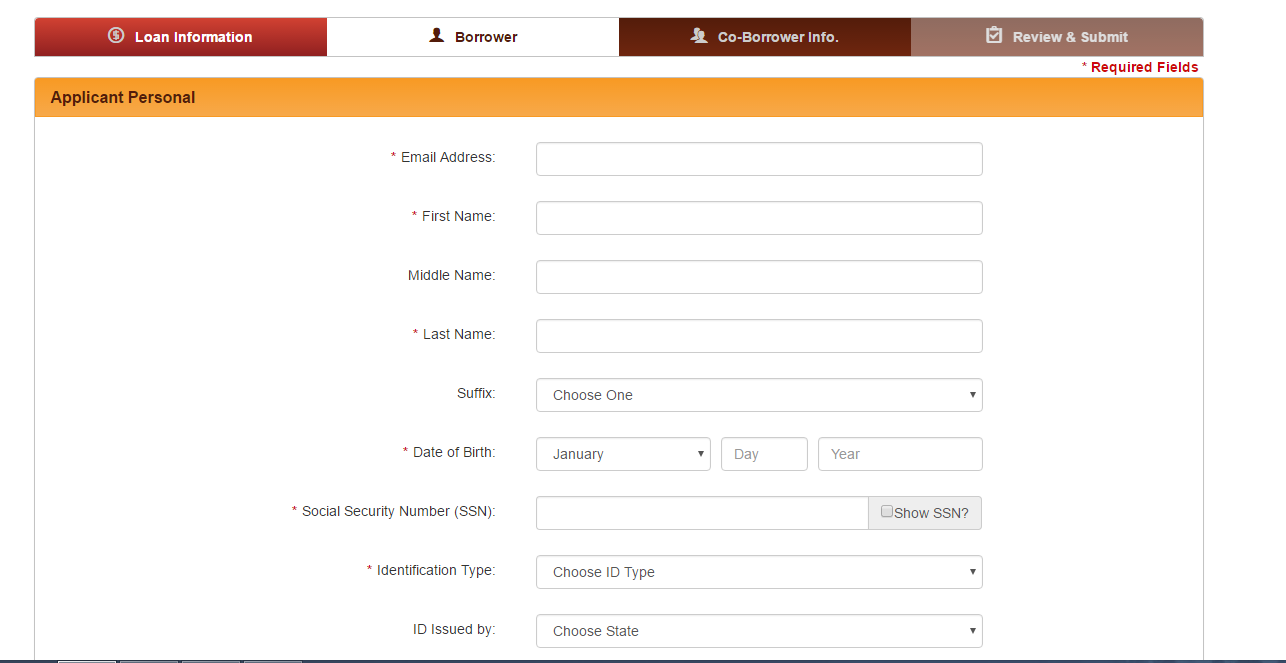

This will take you to the application page. The page is divided into four sections- Loan information, Borrower, Co-borrower and Review and Submit.

In the Loan information part, you need to give details like whether you are a current Charter Oak member. You need to specify the type of Credit Card you want, Visa Platinum or Visa Platinum Variable. You would also need to specify whether you want to include a co-applicant or not. The applicant should also put in the requested credit amount. After filling in all the details correctly, click on Next.

Step 3 - Fill in the Personal Information

The Next page will appear in front of you. Here an applicant needs to fill in their own details.

The page is divided into two categories Applicant Personal and Applicant Residence. In the Applicant Personal section, an applicant has to fill in their personal details. Details like name date of birth, social security number. Identification type, ID issued by, ID number, ID expiry date and Marital Status are required.

In the Applicant Residence section, an applicant's address, city, state, zip code, home and mobile phone number, time at residence, housing type, monthly payment and the details of landlord or lender are required to be filled.

Step 4 - Review the Application

After filling in all the details, you can click next. If you have chosen a co-applicant, you will be taken to the Co-borrower page where the personal details of the co-borrower need to be filled. Details like their name, address, relation with you, etc. are generally required. After filling all these details, click next again to reach the Review and Submit part.

If you have not ticked the Co-applicant section, you can skip the co-borrower part and reach the Review and Submit page. Here an applicant needs to review and recheck all the filled in details carefully. If any error is found, remove it. If you are sure that the form is correctly filled, click on Submit. Now you have to wait for the approval from Charter Oak FCU.

If you have not ticked the Co-applicant section, you can skip the co-borrower part and reach the Review and Submit page. Here an applicant needs to review and recheck all the filled in details carefully. If any error is found, remove it. If you are sure that the form is correctly filled, click on Submit. Now you have to wait for the approval from Charter Oak FCU.

Articles Related to Charter Oak Visa Platinum Credit Card

How to Apply for the Amex EveryDay Preferred Credit Card

How to Apply for the Spirit Airlines World Mastercard

How to Apply for the JCPenney Credit Card