How to Apply for ABNB Visa Platinum Credit Card

To get their application for a ABNB Visa Platinum credit card approved, a user has to be eligible for it. You will need to be at least 18 years of age, and to be a citizen of the United States of America, or in other words - to have a valid street address located in the United States as well as a legitimate social security number. You should also be a member of the South Hampton Roads community.

To get their application for a ABNB Visa Platinum credit card approved, a user has to be eligible for it. You will need to be at least 18 years of age, and to be a citizen of the United States of America, or in other words - to have a valid street address located in the United States as well as a legitimate social security number. You should also be a member of the South Hampton Roads community.

How can i apply for the ABNB Visa Platinum credit card?

Applying for the ABNB Visa Platinum credit card is very straightforward. It can be done online or via phone if you prefer.

You can apply for the ABNB Visa Platinum card simply by visiting their website which can be found here and following the instructions provided in the following text.

You can also apply via phone, by calling the customer service number.

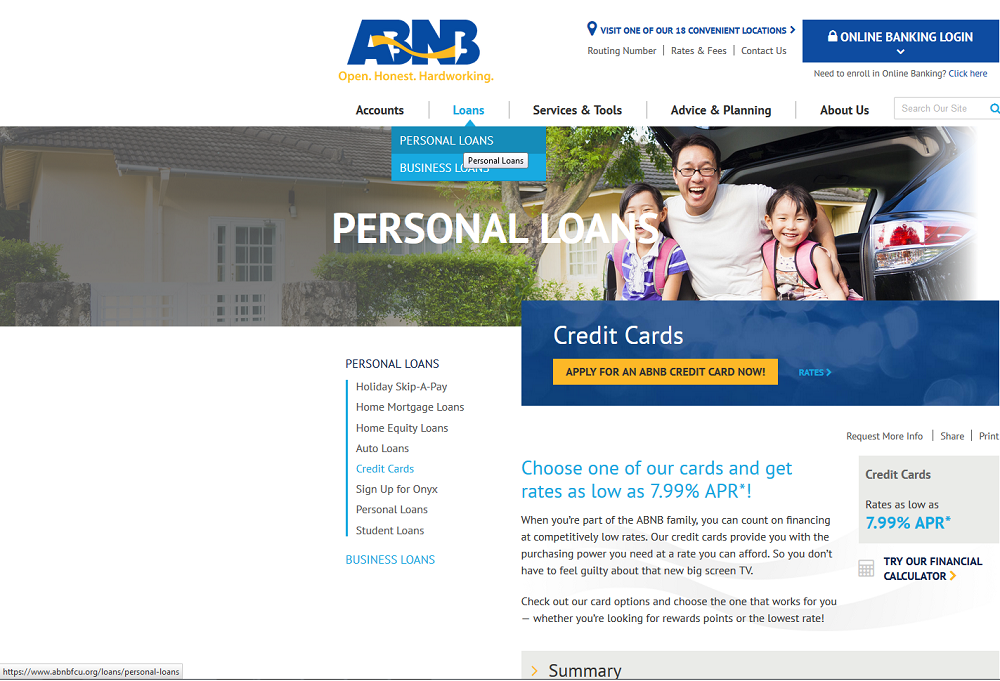

Step 1 - Go to ABNB Website

Go to https://www.abnbfcu.org and click on the loans menu in the upper part of the screen. After doing this you should choose the personal loans option, as the ABNB Visa Platinum is located here, and choose credit cards from the drop down menu.

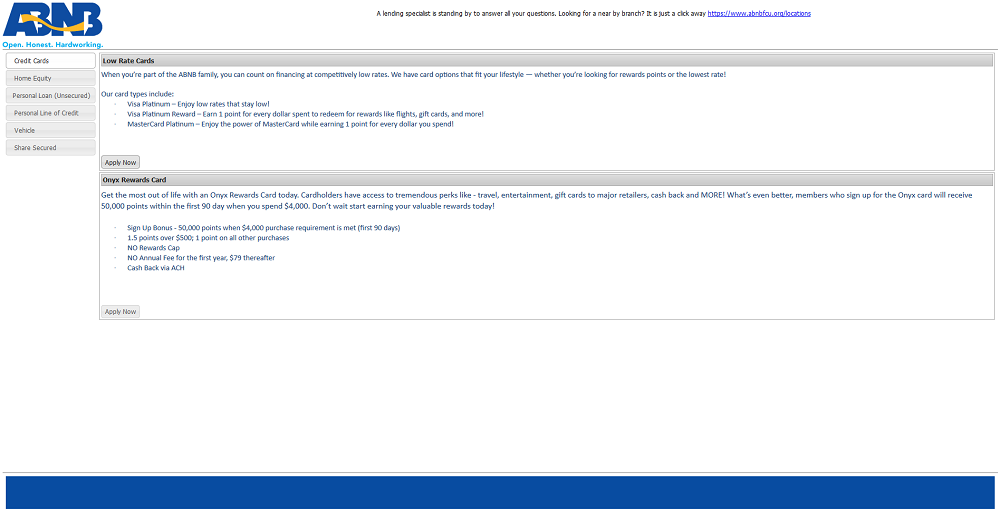

[Next you will see the APPLY FOR AN ABNB CREDIT CARD NOW button. Clicking on that will take you to another menu where you should choose the low rate cards option and click on the apply now button, which will take you to the next step.

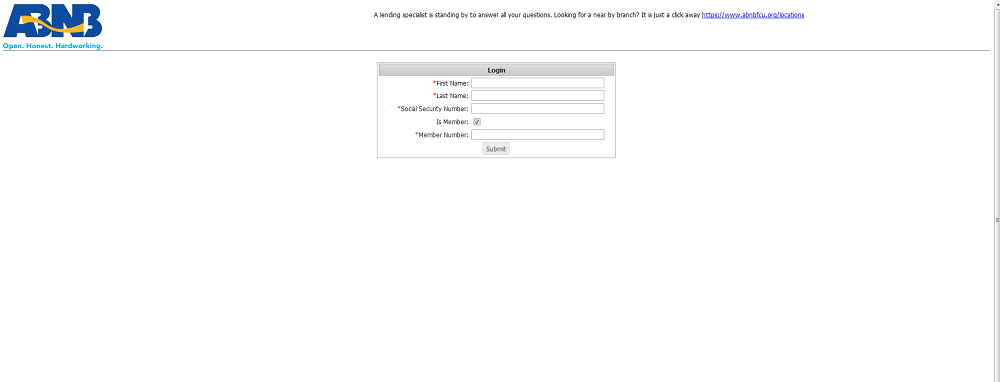

Step 2 - Fill In the Application Form

This is among the most important steps, so make sure to follow this correctly and double check the information you enter. It would also be good to check the service policy to make sure that your information is used properly and securely.

The user looking to apply for this card is required to fill the following information:

- First name

- Last name

- Social security number

- Is member (yes or no; check this box if you are already an existing member)

- Member number (fill in your member number if you are an already existing member)

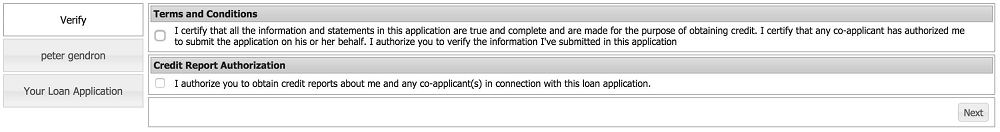

Step 3 - Agreeing on terms

You should always carefully read the terms and conditions of service. After doing so, check all of the boxes under terms and conditions, and credit report authorizations, and click next.

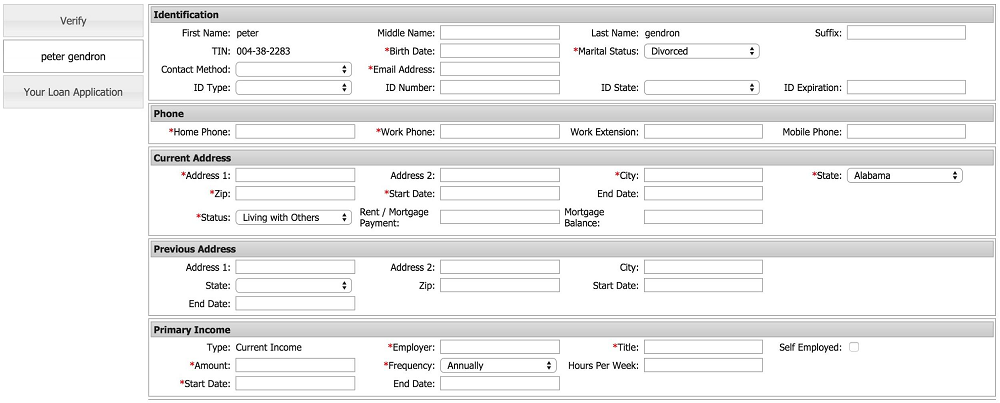

Step 4 - Personal information

This step requires you to enter all of the personal information that will be used to allow your loan application. Be careful to accurately fill in all of the information and make sure to check.

Enter the required personal information for:

- Identification

- Phone

- Current Address

- Previous Address

- Primary income

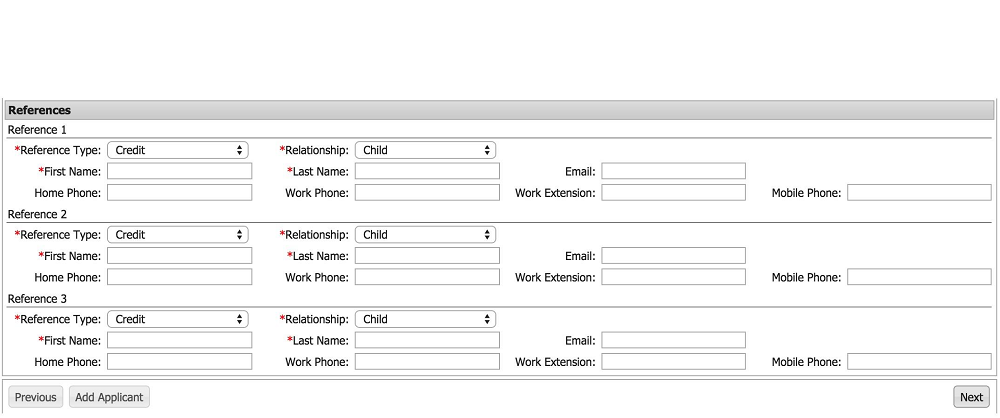

Step 5 - References

State three references and click next.

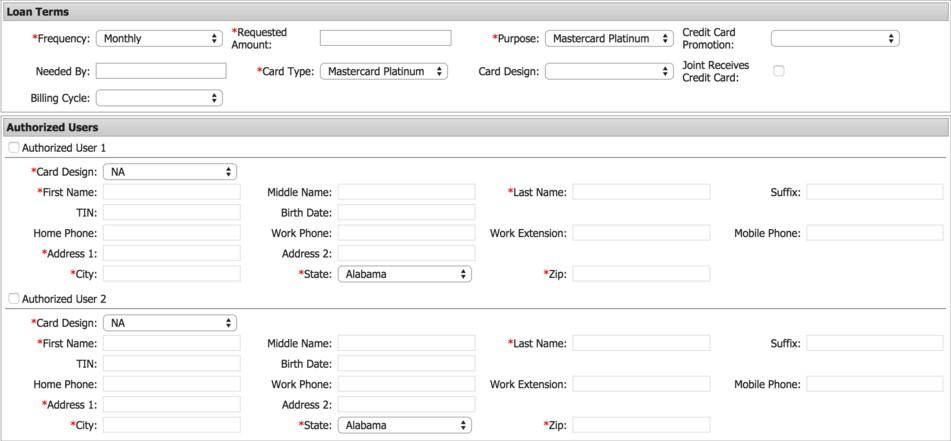

Step 6 - Terms and Authorized Users

This step requires you to fill in information about the loan terms as well as the user which will be authorized to use the card.

FIll in all of the necessary information for loan terms and authorized users, make sure to double check all of the details you entered, and click submit.

FIll in all of the necessary information for loan terms and authorized users, make sure to double check all of the details you entered, and click submit.

Once this is done, you will receive an email confirmation. Your credit score will be checked to approve the card, and to determine your annual percentage rate. Once all of this is complete, you will receive the card at your home address.

Articles Related to

How to Apply for the Amex EveryDay Preferred Credit Card

How to Apply for the Spirit Airlines World Mastercard

How to Apply for the JCPenney Credit Card